Meat News

Supermarkets are “taking advantage of lamb farmers”, according to #NoLambWeek campaigners

Speaking to Meat Trades Journal, one of the farmers behind the #NoLambWeek campaign said it needed to happen to raise awareness of the issue.

Remaining anonymous to protect his identity and that of his farm, he explained how his business stands to lose £25,000 this year alone and that lamb prices are not going to increase anytime soon while the supermarkets keep retail prices the same.

“If they brought the price of lamb down, it would increase demand and we would all win. Instead though, they’re buying in lamb from New Zealand and flooding the market. We understand there are other factors affecting the market such as currency fluctuations but British supermarkets should be supporting British farmers and British produce but instead they’re just abusing them.”

According to farmers, their share of lamb sold on supermarket shelves has dropped 10% from 60% to 50% in the last year. This led to a group of lamb farmers refusing to sell their prime lambs between the 1-7 August while some protested at supermarkets.

#NoLambWeek campaigners believed it brought the discussion into the open. “It was more a statement than a protest but it got the general public to realise how bad the situation is. Some farmers are struggling so much that they couldn’t actually afford not to sell their lambs during the week.

“We believe that supermarkets should bring the prices down to reflect the prices being paid to farmers.”

The campaign resulted in throughputs being down by 2% on the previous week as well as generating mainstream awareness of the issue.

It received plenty of support online from the industry however some independent butchers in the area were concerned that it would disrupt supply to their shops. #NoLambWeek campaigners apologised for the inconvenience but said “this is what we’re dealing with every day of the year”.

“It’s unlikely that lamb prices will rise again until spring so we’re stuck in this situation until next year. We do understand that the boycott did affect some butchers who stock and support British meat but supermarkets are screwing farmers and conning the public with their pricing when they should be doing more to promote it as an everyday option. That’s the way the lamb market will succeed. Local lamb is world famous but instead supermarkets are profiteering from cheaper meat from New Zealand and crippling British farmers.”

He added that if the practice continues, the lamb market might be damaged beyond repair. “Lamb consumption is down globally and work needs to be done to make it a viable option for consumers. Farmers and supermarkets should be working together to strengthen the lamb industry.”

The farmer also refused to rule out another #NoLambWeek boycott in the future should the disparity in prices continue.

“The last #NoLambWeek caused prices to increase but they’ve fallen back down again. We don’t have one planned but never say never. I’m not going to let my business die without a fight and neither will other farmers. We have to protect our businesses.”

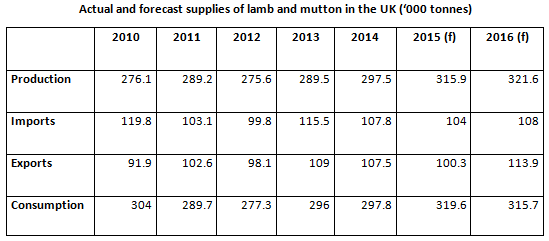

UK lamb and mutton production in 2015 is expected to be up 7% on last year, according to AHDB Beef & Lamb figures.

A large carryover from the 2014 crop led to increased slaughterings in the first half of this year and, with another strong lamb crop, production is expected to be at its highest level for seven years.

Mark Kozlowski, AHDB MI market analyst said: “With supply up, the industry is hoping for favourable changes in retail sourcing and pricing, coupled with continued strategic promotional campaigns linked to product development to draw consumers to lamb over the coming months. If demand isn’t realised, prices may continue to be under pressure.”

The UK breeding flock is now at 14.8 million head. There were year-on-year increases in all regions, with the Scottish flock showing the biggest rise of 5%, according to December 2014 data.

Near-perfect seasonal conditions for the lambing season should mean that the 2015 lamb crop will be around 18.1 million head, over 500,000 (3%) more than in 2014.

With lamb and adult sheep slaughterings up, the total annual sheep meat production for 2015 is expected to be about 316,000 tonnes. Tentative forecasts for 2016 show a small increase in production, mainly due to the larger carryover of lambs. Chart provided by AHDB Beef & Lamb .

AHDB Beef & Lamb has joined forces with the European Union, Interbev in France and Bord Bía in Ireland to create the ‘Lamb. Tasty Easy Fun’ campaign in an effort to tackle the decline in sales and to promote it as an easy alternative to other, more common, meats.

The organisations are calling on farmers to back the campaign, which is costing €7.7 million (£5.45m).

“Lamb is an incredibly versatile protein to cook with and there are many resources that consumers can access for some innovative ideas, not least on the ‘Lamb. Tasty Easy Fun’ website, said Nick Allen, director of AHDB Beef & Lamb.

The marketing push will feature different recipes and information on cuts on its website, as well as a range of different cooking techniques, and will take place over the next three years.

It will aim to increase the likelihood of purchase by 5% among customers by increasing consumer awareness of lamb as a versatile meat that can be used as a part of a daily diet.

“We are all aware of the current pressure on lamb prices and AHDB Beef & Lamb is continuing to work on a strategic promotional campaign to help stimulate demand. In addition, I would call on all producers to get behind the co-promotion campaign and share these resources via social media channels such as Twitter and Facebook to help reach as many consumers as we possibly can. This will help amplify its impact.”

Between 24 August and 20 September, two 15-second adverts will be shown on YouTube, with print adverts across a range of magazines being displayed as of 24 August.

Allen concluded by saying: “Ultimately, our common goal is to stimulate demand for sheep meat. Adopting this joined-up approach will help us reach more consumers and address declining consumption.”

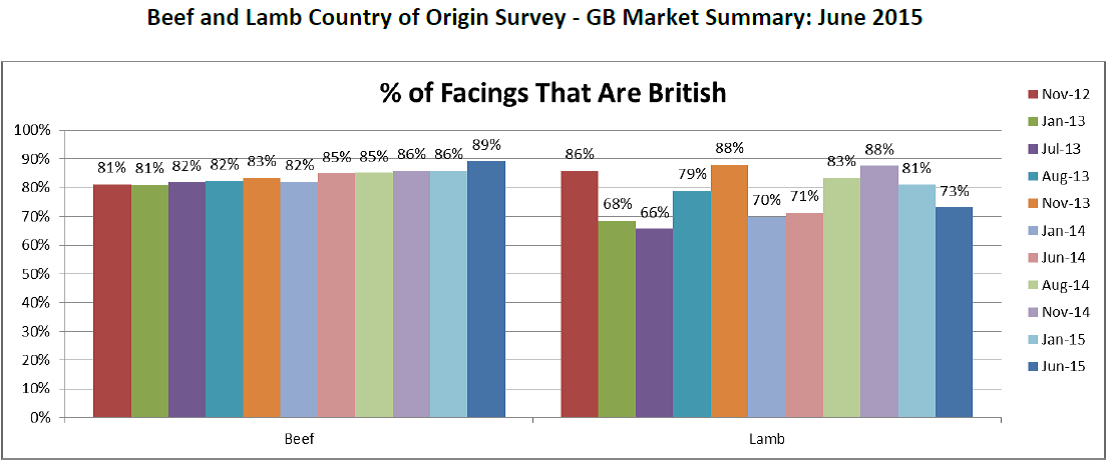

British produce accounts for 73% of all lamb facings in supermarkets.

According to AHDB Beef & Lamb’s Beef and Lamb Country of Origin Survey, just under three-quarters of all lamb products displayed were British. This is up from 71% in June 2014. Aldi, Budgens, Morrisons and Waitrose all had 100% British lamb facings while Marks & Spencer scored 69%, Asda and Tesco both scored 66% and Lidl had 55% of British facings. Sainsbury’s had 54% with The Co-operative bringing up the rear with just 38% of its lamb facings being British.

Talking at this morning’s Royal Welsh Show, Dai Davies, chairman of Hybu Cig Cymru – Meat Promotion Wales, criticised the retailers not stocking enough British lamb. “I urge them to reconsider their sourcing policies and decide whether they really want to sacrifice the long term future of the UK’s supply chain for a short term gain.”

Last week HCC announced plans to improve sales of the lamb industry which included campaigning retailers. “We have been talking to the multiple retailers about their roles, urging them to give greater prominence to Welsh Lamb and we are diverting more money into our annual Welsh Lamb advertising campaign, launching it almost two months earlier than normal,” said Davies.

Asda recently pledged to support the UK’s sheep farming industry by ensuring that most of its lamb will be UK-sourced as of mid-July.

AHDB Beef & Lamb chairman Stuart Roberts welcomed this announcement. “I am writing to Asda to congratulate them on the move to source more home-produced lamb. Moreover, since we have just benchmarked the supermarket – along with all the other multiple retailers – as part of our Lambwatch work to track facings of British lamb, I will be offering to repeat the exercise in six weeks’ time to show how far the retailer has moved forward.

“I think credit should also go to those retailers who consistently score highly in our research in terms of stocking British lamb. Aldi, Budgens, Morrisons and Waitrose were all found to have 100% British in the June survey.

” On the beef side, 89% of facings in the supermarkets in June were British, up from 85% in June 2014. Aldi, Budgens, The Co-operative, Lidl, M&S, Morrisons and Waitrose all had 100% British beef facings. Asda had 71%, Sainsbury’s had 97% and Tesco had 87%.

Hilton Food Group has posted a half-year trading update that is “in line with expectations”.

Citing challenging consumer conditions and the appreciation of sterling against other currencies having an effect on the meat packing company’s performance for the 28 weeks ended 12 July 2015, Hilton said it has expanded over the past six months. It is also looking to grow opportunities in both domestic and overseas markets.

Its trading update stated: “We have continued to grow the business, through additional volumes and close cooperation with our retail partners.

“In Western Europe, we have made good progress in a number of markets. In the UK, where we have expanded our production facilities, volumes have continued to build towards anticipated levels.

“In the Dutch market, we have continued to see volume growth, and have helped

Albert Heijn in the development of its recently opened innovation centre. We are also encouraged by the performance of our business in Ireland, where we have seen growth in the first half of 2015. For both Sweden and Denmark, conditions have remained testing, while in Central Europe, where Hilton supplies customers in seven countries, trading has been in line with the board’s expectations.

“In Australia, development work by the joint venture at Victoria is proceeding in line with the agreed plan, with the equipping of the plant substantially complete and test-running having commenced ahead of start-up in the third quarter.”

Employees from Cranswick Country Foods set off on a 115-mile round bike ride to raise funds for the Yorkshire Air Ambulance.

The second annual Flying Pigs Charity Bike Ride saw the 25 cyclists set off from the Lazenby’s site in Hull at 6.45am, travelling to the Gourmet Bacon site in Sherburn, then on to the Gourmet Pastry site in Malton and finally back to the Lazenby’s site.

The riders hope to reach a fundraising total of £12,000 for the Yorkshire Air Ambulance.

One of the riders, Mary Banks, category marketing and insights controller for Cranswick Country Foods, said: “It was a real team effort and although we are all keen cyclists, this was a very long route to undertake in one day. Thank you to everyone who generously supported us.

“Supporting local charities is important to us at Cranswick. We are proud to be a part of this region – we invest heavily in jobs and facilities, but it remains important to us to give charitable support and we are delighted to be supporting the Yorkshire Air Ambulance again.”

London butcher The Ginger Pig is to start selling charcoal alongside its meat.

The premium charcoal, called Chef’s Blend, is to be supplied exclusively to the butcher’s shop by The London Log Company, and will be available from 26 June in the Ginger Pig’s shops in Clapham, Shepherd’s Bush, Hackney, Marylebone and Barnes.

According to its makers, Chef’s Blend is a mix of beech, birch, oak and ash with a little English fruitwood, which create aromatic flavours that work especially well with dry aged grass and beef fed lamb, but are subtle enough to use with all meats.

Mark Parr of the London Log Co was excited about the partnership: “The Ginger Pig are as obsessed about beast, taste and welfare, as I am about wood, fire and flavour, so a collaboration was as easy as falling off a log, so to speak. We share a common passion for food and its provenance; a mutual respect for the land where we grow our produce, the people involved and the joy that the end product engenders. To be able to work in your chosen field (or woodland) and strive to produce excellence is a gift. To share your work and have that recognised by others, is even better.”

Foodservice companies looking to gain customers’ trust should use more British meat and making customers aware of it, according to the National Pig Association (NPA).

Nearly 70% of shoppers trust the meat they buy in supermarkets either a lot or a fair amount, compared to only 58% of those who said they trusted the meat they are served in restaurants and just 17% in fast food restaurants, according to a recent YouGov survey.

The NPA pointed to Sainsbury’s as a good example of a company that has seen its business boosted by the implementation of a policy of only using British pork, ham and sausages. It has since rolled this out to include its sandwiches and in-store cafes, resulting in a 10% upturn in this part of the business.

We know sourcing more British meat and promoting the fact on-pack to customers means supermarkets have stolen a huge lead on restaurants and fast-food chains when it comes to gaining public trust,’ said NPA chairman Richard Lister.

“If foodservice companies want the public to trust them to a similar degree, the answer is staring them in the face. They should copy Sainsbury’s by serving British pork and pork products, and advertising the fact widely.

Sainsbury’s makes a point of using the Union Flag on pork products in-store, and is now extending this to its foodservice message. It says the use of British pork will continue to raise consumer awareness and consumption of British pork.

J Sainsbury’s has reported like-for-like retail sales down 2.1% excluding fuel during the 12 weeks to 6 June, 2015.

Total retail sales for first quarter were down by 0.6% (excl fuel) and also down 2.3% (inc fuel).

Mike Coupe, chief executive, said that “strong levels of food deflation and a highly competitive pricing backdrop” are impacting trading conditions.

He added that the grocer, which is known for its “differentiated offer”, introduced new products in several categories focusing on British sourcing wherever possible during the first quarter.

“We have also improved our seasonal fresh offer in time for summer. For example, our by Sainsbury’s BBQ Smoked Chilli Pulled Pork and by Sainsbury’s BBQ Sweet Chilli Chicken Thighs give customers meat cuts and flavours that are perfect for the barbeque,” he said.

“Volume and transactions continue to grow as customers are benefiting from our improved value and further investments in quality. We have simplified our promotional offer, which has reduced promotional participation further, helping to lower waste and give customers even better levels of availability. We committed to deliver our cost savings programme without impacting the customer experience.

“We continue to make it easier for customers to shop with us whenever and wherever they want. We have now opened 20 grocery Click & Collect sites and remain on track to have 100 sites by the end of 2015.”