Lidl News

The National Pig Association (NPA) has praised supermarkets, including Lidl, for giving over more shelf space to British pork

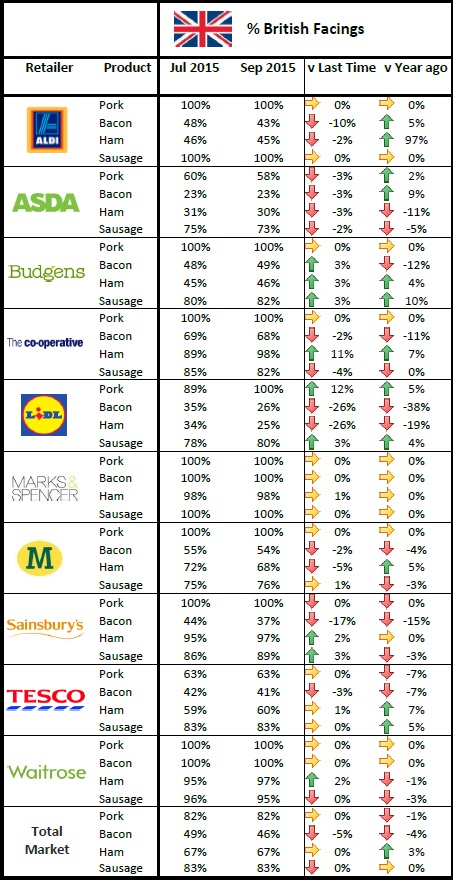

According to the latest Porkwatch survey from AHDB Pork for September, 100% of pork sold by Lidl was British.

The discounter joins the likes of: Aldi, Budgens, Co-op, M&S, Morrisons, Sainsbury’s and Waitrose in stocking 100% British pork. Asda and Tesco were reported to have 58% and 63% of facings that were British, respectively.

“We’re delighted with this news and hope Lidl will demonstrate over the months ahead that it isn’t a flash in the pan,” said NPA chairman Richard Lister.

Chief executive Dr Zoe Davies added that supermarkets needed to support the British pork industry and that it would continue to endorse those that do.

She said: “If retailers and foodservice want the convenience of a thriving British pig sector on their doorstep, producing reliable supplies of a quality-assured, traceable, high-welfare product, then it’s essential they make a special effort to source British pork, sausages, bacon and ham over the difficult months ahead.

“We’re carrying on with our Keep It Up campaign, which commends those retailers who have stood by their post-Horsegate pledges to source more British pork.”

According to the NPA, producers are no longer breaking even as a result of falling prices over the past year. The Standard Pig Price has dropped from 151p this time a year ago to 128p this week, while the break-even point is 139p.

More growth for discount retailers, but Sainsbury’s was the only ‘big four’ retailer to post sales growth over the last month, Kantar data shows

Lidl has achieved a new record share of the UK grocery market.

This is the second successive month Lidl has reached a new share high, and now claims 4.3% of the market, after seeing its growth accelerating to 17.9% in the 3 months to 11 October 2015.

The discount retailer’s growth was particularly strong in Scotland, the scene of its ‘smarter shopping’ card trial.

The latest Kantar Worldpanel data also shows that Aldi saw its revenues rocket by 17.6% compared to last year’s figures.

Sainsbury’s was the only one of the larger supermarkets to see sales growth this period, and a strong performance in its online and c-store channels helped it to increase revenues by 1.1%.

However, Sainsbury’s market share was static at 16.1%.

Sales fell at Tesco by 1.7%, though it is too early to see the impact of its revamped ‘Brand Guarantee’ initiative. At Asda, sales fell by three per cent, bringing its market share down by 0.7 percentage points to 16.6%.

Meanwhile, sales at Morrisons fell by one per cent, taking its grocery market share to 10.8%

Fraser McKevitt, of Kantar Worldpanel, said: “In contrast to the overall market, online grocery sales have increased by 9.8% on last year. Despite this rapid expansion, space for retailers to increase both share and revenue in this area remains, with less than a fifth of households currently shopping online.

“Internet sales offer a chance of long term growth – only 18% of households bought groceries online in the last 12 weeks meaning there’s plenty of space for further expansion. The convenience factor and minimum spend restrictions mean online baskets tend to be larger, averaging £67 in value, compared with £14 for the average bricks and mortar trip.

“Amazon Fresh’s expected full launch early next year could be a major disruptor, bringing down average basket sizes, accommodating on demand shopping, and accelerating the growth of the whole online market.”

There has been further success this period for Waitrose, with sales up by 2.1%; The Co-operative also saw sales grow by one per cent, and Iceland grew for the sixth month in a row, increasing sales by 3.2%, benefitting from a wider range of premium products.