Lamb

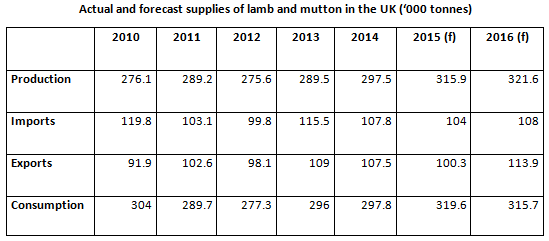

UK lamb and mutton production in 2015 is expected to be up 7% on last year, according to AHDB Beef & Lamb figures.

A large carryover from the 2014 crop led to increased slaughterings in the first half of this year and, with another strong lamb crop, production is expected to be at its highest level for seven years.

Mark Kozlowski, AHDB MI market analyst said: “With supply up, the industry is hoping for favourable changes in retail sourcing and pricing, coupled with continued strategic promotional campaigns linked to product development to draw consumers to lamb over the coming months. If demand isn’t realised, prices may continue to be under pressure.”

The UK breeding flock is now at 14.8 million head. There were year-on-year increases in all regions, with the Scottish flock showing the biggest rise of 5%, according to December 2014 data.

Near-perfect seasonal conditions for the lambing season should mean that the 2015 lamb crop will be around 18.1 million head, over 500,000 (3%) more than in 2014.

With lamb and adult sheep slaughterings up, the total annual sheep meat production for 2015 is expected to be about 316,000 tonnes. Tentative forecasts for 2016 show a small increase in production, mainly due to the larger carryover of lambs. Chart provided by AHDB Beef & Lamb .

In response to dropping lamb prices, a group of Welsh farmers plan to withhold their prime lambs between August 1-7.

It is believed the plan was conceived at the Royal Welsh Show earlier this month and it is hoped the move will raise public awareness of British farming and highlight the fact that retail prices have not followed the slump in farmgate lamb prices.

A statement on the group’s Twitter feed stated: “With the price of lamb daily, we are trying to get UK sheep farmers to support #NoLambWeek. We hope no one will sell lambs the first week of August. We could block the roads with tractors, but that just annoys the public. Or we could do nothing and complain.

A statement on the group’s Twitter feed stated: “With the price of lamb daily, we are trying to get UK sheep farmers to support #NoLambWeek. We hope no one will sell lambs the first week of August. We could block the roads with tractors, but that just annoys the public. Or we could do nothing and complain.

“So why not get together and show the public what the supermarkets are doing to the British farmer?”

Welsh mountain lambs were this week selling at £44 liveweight, a six-year low, while farmers’ share of the retail price has dropped from 60% last June to 50% this year. Latest Hybu Cig Cymru – Meat Promotion Wales (HCC) figures state that Welsh farmers are receiving between £25 and £30 less per lamb than a year ago, due to a strong pound and increased red meat imports.

A spokesman for HCC said: “We understand the frustrations felt by sheep farmers who have seen the price paid for their lambs fall substantially over the last few months. As a result HCC has held talks with the major multiple retailers encouraging them to place greater emphasis on sales of home-grown lamb to secure the long term future of the UK’s supply chain.”

Support for #nolambweek is growing online. Caerphilly butcher Chris Hayman said via Twitter he was “split on #nolambweek”. “The people who will suffer will be butchers, like me, who buy local, and supermarkets will import, but I do agree prices are too low for you guys to earn a crust.”

The halal sector adds value to the sheep market in particular and, increasingly, for the cattle market. Halal presents a significant market opportunity, which processors can capitalise on, particularly when it comes to sheep meat.

In addition the statistics speak for themselves. Sheep meat is a primary protein choice for Muslim consumers, and with a UK population of 2.7 million – 4.8% of the total population – there is a clear market for sheep meat producers to focus on.

As with any industry, it is vital to fully understand the market and, in the case of the halal sector, keep a keen eye on the Islamic calendar to plan production and deliver products at key times of the year to maximise the market’s full potential.

After all, the Muslim community consumes around 20% of all the sheep meat sold in England, with consumption peaking around the Ramadan and Eid festivals.

Processors should plan accordingly with suppliers, to target the Muslim market throughout the year. Ramadan, for example, falls in the ninth lunar month of the Islamic calendar, when nothing is eaten between dawn and sunset. Food is, however, celebrated at larger social gatherings in the evenings, helping to drive up demand. The Islamic calendar is lunar-based, so dates move back about 10 to 11 days every year.

This year Ramadan began on 18 June. Next year it will begin on 7 June, underlining how crucial it is to plan to maximise the market’s potential.

Similarly, the festival of Eid-al-Adha is held approximately 70 days after the end of Ramadan, where it is incumbent upon every Muslim to follow in the footsteps of the Prophet Abraham and have an animal slaughtered as an offering to God. Called the Qurbani, meat is received in three portions – one for the person buying, one for friends and neighbours, and one for charity, again helping drive a spike in demand. During this period, the community looks for mature animals, aged six months or older that are fit, healthy and lean.

Further opportunities are presented in export markets. The UK is the biggest sheep meat producer in Europe and the largest exporter. The UK exports around the margin of 35% of its sheep meat production, the vast majority of which goes to Europe, and Europe’s Muslim population is expected to grow from 6% in 2010 to 8% in 2030. With a potential 15.4 million Muslim customers in Europe, we are in a strong position to cater for the demand. France, for example, is the UK’s largest export market for sheep meat and, with a considerable Muslim population, represents a significant market opportunity.

Indeed, many supermarkets in France now offer halal-specific aisles. Further afield, with growing market access and approvals, the UK is in a good position to capitalise on global demand for halal products.

The picture looks positive. While public perception of halal is often tainted by a lack of understanding of the sector, the reality is that it presents a valuable market opportunity. By fully understanding the market and key dates in the Islamic calendar, the UK sheep meat industry is ideally placed to reap the rewards offered by the halal sector.

Therefore, there are fantastic opportunities that the halal market presents the sheep meat sector. AHDB Beef & Lamb has produced a number of resources to help the industry harness the market’s potential.

Other resources include our halal cuts posters and the Lamb Cutting Guide for the halal market, developed as a training tool and to provide a single comprehensive specification to ensure consistency throughout the halal industry. Our Halal Meat Facts booklet, for example, also gives a snapshot of key statistics and the opportunities presented by the sector in the UK and in export markets.

Further information on halal can be found in the halal section of the AHDB Beef & Lamb Trade website www.qsmbeefandlamb.co.uk and the Corporate Publications section of the AHDB Beef & Lamb website beefandlamb.ahdb.org.uk.

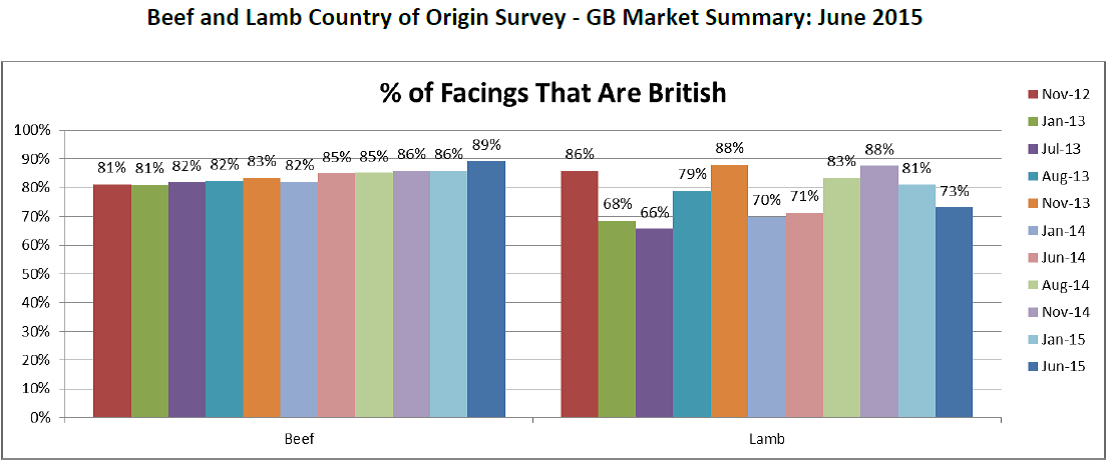

British produce accounts for 73% of all lamb facings in supermarkets.

According to AHDB Beef & Lamb’s Beef and Lamb Country of Origin Survey, just under three-quarters of all lamb products displayed were British. This is up from 71% in June 2014. Aldi, Budgens, Morrisons and Waitrose all had 100% British lamb facings while Marks & Spencer scored 69%, Asda and Tesco both scored 66% and Lidl had 55% of British facings. Sainsbury’s had 54% with The Co-operative bringing up the rear with just 38% of its lamb facings being British.

Talking at this morning’s Royal Welsh Show, Dai Davies, chairman of Hybu Cig Cymru – Meat Promotion Wales, criticised the retailers not stocking enough British lamb. “I urge them to reconsider their sourcing policies and decide whether they really want to sacrifice the long term future of the UK’s supply chain for a short term gain.”

Last week HCC announced plans to improve sales of the lamb industry which included campaigning retailers. “We have been talking to the multiple retailers about their roles, urging them to give greater prominence to Welsh Lamb and we are diverting more money into our annual Welsh Lamb advertising campaign, launching it almost two months earlier than normal,” said Davies.

Asda recently pledged to support the UK’s sheep farming industry by ensuring that most of its lamb will be UK-sourced as of mid-July.

AHDB Beef & Lamb chairman Stuart Roberts welcomed this announcement. “I am writing to Asda to congratulate them on the move to source more home-produced lamb. Moreover, since we have just benchmarked the supermarket – along with all the other multiple retailers – as part of our Lambwatch work to track facings of British lamb, I will be offering to repeat the exercise in six weeks’ time to show how far the retailer has moved forward.

“I think credit should also go to those retailers who consistently score highly in our research in terms of stocking British lamb. Aldi, Budgens, Morrisons and Waitrose were all found to have 100% British in the June survey.

” On the beef side, 89% of facings in the supermarkets in June were British, up from 85% in June 2014. Aldi, Budgens, The Co-operative, Lidl, M&S, Morrisons and Waitrose all had 100% British beef facings. Asda had 71%, Sainsbury’s had 97% and Tesco had 87%.

Offal distributor Elmgrove Foods has made the Sunday Times Virgin Fast Track 100 list, made up of country’s fastest-growing companies.

Elmgrove Foods of Co Tyrone, Northern Ireland, produces more than 100 beef, lamb, pork and chicken offal products, which are all distributed internationally. The company made it to 62 on the Sunday Times list.

To make it into the top 100, companies must have an operating profit of over £500,000 and annual sales must exceed £250,000. The distributor makes 100% of its profits from exports.

Stuart Dobson, managing director, said he was “thrilled” to have made the Fast Track 100 list, adding that the market for fifth-quarter products continues to grow.

“The export business for offal is becoming more and more competitive, with increased numbers of UK export start-ups and international customers coming direct to source products. Forging and maintaining long-lasting relationships between suppliers, customers and our strong team have been our recipe for the company’s success. Elmgrove’s key is creating new products regularly, our portfolio has over 100 products, which are of high quality and exceed customer expectations,” Dobson told Meatinfo.co.uk.

Elmgrove Foods also won last year’s Food and Drink Federation Exporter of the Year award, as well as the Queen’s Award for Enterprise 2013.

Richard Branson, owner of Virgin, which has sponsored the fast-track list since it began in 1996, said: “This year’s Fast Track 100 is packed full of examples of entrepreneurs taking on many different challenges head-on. Their success is based on real team spirit and it is this togetherness, above and beyond any other factor, that sets great businesses apart from also-rans. The Fast Track 100 is testament to that spirit of creativity and camaraderie.”

Protected Geographical Indication (PGI) West Country Beef has been chosen by Tesco for use in its ‘Finest’ range.

The PGI beef, sourced from Two Sisters Foods in Bodmin, Cornwall, will fill Finest Steak Pies, made by Tamar Foods in Callington, also in Cornwall, for stores nationwide.

/>The West Country PGI status, which covers both lamb and beef, was obtained thanks to work done by strategic advisory body Meat South West (MSW) and other organisations.

Peter Baber, chairman of MSW, said: “We worked incredibly hard to help secure the PGI for both West Country Beef and West Country Lamb. Tesco’s decision to use West Country Beef in its Finest steak and steak and ale pies is a direct result of those efforts.

“It is incredibly promising news for West Country produce. We are delighted with the outcome and the benefits that will bring to the region’s farmers and processors, who can take advantage of the premium status given to the region’s beef and lamb now eligible to carry the PGI.”

To qualify for the protected status, the lamb and beef must be at least 70% forage-fed, and come from stock born, raised and finished in Cornwall, Devon, Somerset, Gloucestershire, Dorset or Wiltshire.

Gary Bound, purchasing manager for Tamar Foods, said: “We are delighted to be able to use PGI West Country Beef in this top-tier product for our retail customer. The recent awarding of PGI status has given us the opportunity to use high-quality, regional beef, which reduces food miles, secures employment locally and adds value to the regional economy.”

A young butcher has been declared the Yorkshire champion in the 2014 Young Butchers Creative Meat Display Competition.

The event, which is was organised by butchery supplier Dalzeil, saw Joe Smith, from Lishman’s of Ilkley, steal the crown during a close fought competition in Glasshoughton, near Wakefield.

Joe, 21, said: “We were given two hours to work our magic on shoulders of lamb and pork, a knuckle of beef and a brace of chickens. We had to cut them up and make as many dishes as possible out of these products without having any waste.

“The judges were looking at our butchery and presentation skills and the imagination used to create the products. I produced 15 different dishes in total and was over the moon to be chosen as Yorkshire champion. Events like these are a great learning curve.”

Joe, who holds a NVQ Level 2 Meat & Poultry qualification and has completed his apprenticeship, has worked at Lishman’s for the past four years and has progressed quickly, with his efforts seeing him recently promoted to assistant shop manager.

Joe received a trophy, certificate, £100 worth of vouchers and butchery knives to the value of £200, presented by the British and Commonwealth featherweight boxing champion Josh Warrington, of Leeds.

Dalziel’s regional operations manager Mike O’Hara praised all the contestants. He said: “They demonstrated a high level of professionalism and excellent butchery skills. The overall displays were very impressive and inspirational.”

Beef, lamb and pig meat production has increased on last year, according to the latest slaughter figures from Defra.

The figures compare June 2013 with June 2014 and show clean sheep slaughterings – which refers to animals that have been bread purely for slaughter – at 907,000 head for the month, just over 8% higher than in June 2013, while mutton and lamb production was at 21,000 tonnes, 5% higher than in June 2013.

Clean pig slaughterings were 3.7% higher than last June at 772,000 head and pigmeat production was 6% higher at 64,000 tonnes.

Although prime cattle slaughterings were down 0.5% and 150,000 head this year, beef and veal production was almost 3% higher than June 2013 due to continuing heavy carcass weights, according to Defra.

Stephen Rossides, director of the British Meat Processors’ Association, commented on the cattle figures: “Overall [there was] lower beef production in June. But I think for a fuller picture of the market, a longer time frame needs to be taken, as well as trends in imports, exports, retail demand and weather factors.”

Defra said the report is subject to revision in August when they will publish the updated figures.

Another meat body has expressed its concern at the fall in lamb prices as supply increases.

After Quality Meat Scotland (QMS) reported a cooling of lamb prices, Hybu Cig Cymru – Meat Promotion Wales (HCC) has joined the discussion, confirming that a greater number of lambs have come into market earlier than usual. Like QMS, HCC has also cited the strong pound against the euro as a contributor to the problem.

The UK beef industry has already been suffering from a farmgate price crisis, and summits have been held to find solutions.

John Richards, HCC’s industry information executive, said: “This year, thanks to a good lambing season and mild weather, there is a significant increase in the number of lambs now reaching the market. It must also be borne in mind that lambs are entering the market earlier this year, extending the season. It means that the traditional seasonal trend has occurred a few weeks earlier in comparison to other years.”

HCC said the falling lamb price highlights the importance of diversifying exports. Richards added: “This reinforces HCC’s strategy of looking for other markets around the world, so that we are not entirely dependent on one currency for our export trade. We are already exporting Welsh Lamb to the Middle and Far East, as well as Scandinavia and Canada, while working to gain entry into new markets including China and the USA.”