Horticulture

We interviewed John Elliott of Entpack to find out his thoughts on how packaging in the food industry is changing?

Will reusable packaging options become more prevalent?

It seems very likely that reusable packaging will become more common. The use of single-use non-recyclable packaging options is in rapid decline: take plastic straws for example.

We need to clarify the interpretation of single-use. A better term would be single-use widely non-recyclable plastic materials. Not just single use. For example, HDPE milk bottles are single use but successfully recycled and from an environmental perspective better than traditional glass

It is not just a UK consideration though; it is fast becoming a global issue. The Indian Prime minister Narendra Modi has recently announced India will eliminate all single-use plastic by 2022.

The biggest drive will be to design packaging and systems that deal with packaging once they are no longer needed; be that recycling or secondary use.

The focus will be on how to grow the notion of the circular economy of plastic, i.e. how to ensure that plastic is infinitely recycled.

Will there be an even bigger shift towards using materials which are more readily recyclable?

We have already seen the development of new materials which are easier to recycle. This refers particularly to materials which have good gas barrier properties. Traditionally, such packaging solutions were made with multi-layer laminated plastic structures which helped to increase a product’s shelf life.

New recycling technologies are readily being commercialised that will be able to handle laminated materials that in the past were not recyclable.

Will supermarkets revert to the traditional means of displaying and selling food/fresh produce, loose and if so, what impact will that have on manufacturers and producers?

Retailers have already started to do this and are trying to increase sales of loose fruit and vegetables. Logic suggests that this trend should continue to grow. The reality is, however, that consumers still prefer the convenience of pre-packaged goods; for example, people favour to buy six apples already in packaging, rather than picking up six loose apples and bagging them up themselves. It is the same amount of fresh produce, but convenience seems to always prevail.

What is more, prewrapped goods give the impression of being more hygienic – fewer people have touched the produce, thus anxieties over cross-contamination are lessened. That being said, you should always wash your fruit and veg, prior to consumption, pre-packaged or not.

What are the possible alternatives to plastic, particularly single-use?

Paper packaging seems to be gathering preference over plastic – has great consumer appeal; the perception is that paper or even metal are better environmental alternatives. The truth is, however, that both are processed materials, and both can have negative impacts, and a greater environmental burden plastic.

Will shifts in packaging strategies have an impact on quality control and preserving goods?

No, we expect that the quality and shelf life of products to improve upon the current levels, thanks to ongoing improvements in technology, research and development.

How does society and the media influence packaging trends?

We would suggest there is a great deal of miseducation being presented about plastics. As a result, the public is being misinformed. The consumers which are privy to ongoing press attention, drive sales which in turn impacts on the packaging solutions required. Retailers and manufacturers, therefore, are having to react to help ensure their consumers that the packaging products they use, are sustainable and responsibly considered. Without such reassurances, the consumers will vote with their feet.

How will producers continue to imprint their brand on to goods going forward, if loose produce becomes the norm?

There are a few options out there, such as compostable PLU labels and these are currently used on fruit. Increasing use of technologies most smartphones van read 2D barcodes to direct to a website.

How innovative have manufacturers and producers become in the wake of the shift in packaging demands?

Manufacturers have been quick to respond, with the likes of Waitrose switching out black plastics in six months. The problem will not be resolved overnight though as the issue is embedded within the waste collection infrastructure in the UK. New technologies which aid in separating waste products are slowly coming into play, such as Digimarc, which is led by Proctor and Gamble an initiative from Helen Mac Arthur Foundation.

What timescales are retailers working to?

The government needs to act and help with the recycling of municipal waste. It is planned that by the end of 2022, there will be a packaging taxation system penalising plastics with less than 30 % (to be agreed.) This could be a big game-changer.

One of the main issues is that plastic waste has no real value: it is far cheaper to drill for crude oil than it is to recycle used plastic using the processes available today. Legislation could change this.

Retailers are part of the problem, but they cannot fix it in isolation. A combined effort from all stakeholders (government, retailers, packaging manufacturers, fillers and packers) is required and is in action. We expect that in approximately five years’ time, many changes in relation to packaging will be evident.

Alas, we foresee that the problem may worsen before it improves. Currently, the UK is exporting 60% of its waste to nations overseas. Some countries have now stopped accepting waste, such as Malaysia. They have gone to such extremes that they have returned waste to Canada and have threatened the UK to do the same.

Retailers have the ability to react quickly and very often they do so, but their reactions don’t always fix the problem and as said before, acting in isolation is not the way forward.

Big thanks to John Elliott of Entpack for his industry insight, Henderson Brown has worked closely with John on contract assignments and his business as a packaging industry expert.

A number of key industry speakers took to the stage on Tuesday 8th October at the Ricoh Arena for the FPJ live 2019 conference. So what were the main takeaways?

The B-word, Brexit of course was a major point for discussion. We were also privy to talks on Fresh Produce Brands; the methods and means of producing more fresh produce; sustainability; robotic innovation; health and fresh produce benefits; food waste and climate change.

Have a read below of our own round-ups of the talks that we attended.

Kantar

Joe Shaw Roberts, Insights Director for Kantar discussed sustainability in the produce sector and the ways in which meat consumption is reducing. 81% of those questioned as to why they moved towards a meat-free/reduced diet, cited health reasons as the main motive.

Joe went on to say that some produce sectors are growing whilst others are not. Products which are going in to plant based meat free meals are rising whilst many other fresh produce items such as broccoli and potatoes are not growing as fast as they usually accompany meat as part of an entire meal.

Trends are showing that sales of whole head produce are growing faster than pre-prepared produce with a rise in cooking from scratch due. This could be attributed to consumers wanting to reduce their packaging waste or simply because it is cheaper. Consumers are becoming more careful about what they buy and want more lbs for their pounds. That being said, further findings suggest that 44% of shoppers are now more concerned about selections on packaging too.

Jack Ward (British Growers Association) and Hayley Campbell Gibbons (ADHB).

In a really interesting talk and one which had everyone fully tuned into. The overarching feeling is that Brexit-systems are not in place and the government is not ready for the 31st of October when it is planned that the UK will leave the EU.

There simply are no answers at the moment as to what will happen. However, there is optimism that a deal will be in place and that no matter what, the flow of goods will continue. Clarity from the government is fundamental in trying to get this.

Any perceived threats and opportunities from outside of EU won’t happen day on day one of departure: the 1st November should be the same as 31st October, if not with some port border challenges.

Going forward, DEFRA budgets will also have a focus on supporting on Automation and crop protection.

The British Growers association remain ambitious despite the uncertainty. They have continued to grow and will continue to support the industry and growers.

Avnish Malde (Wealmoor)

Traditionally, Wealmoor had always been a very private, family-run business. Now though they are more in the public eye and are keen to project their values and ethos to the outside world.

They believe that the global supply chain is important as they have many relationships worldwide. There is much going on and they are trying to further integrate and invest in their farming operations in five countries.

Wealmoor is creating more brands, such as Herbfresh and Saxons Asparagus with the view to create a sense of provenance and owning stories about production. In time they think that they can get more brands out there on the global market, but they want to do so, cleverly, whereby the story is central to each.

They went on to say how sustainability is of paramount importance and they are investing in communities and growers. In the likes of Kenya, they plan to attack the issues of climate change head-on for a more promising future.

John Gray (Angus Soft Fruits)

The berry category is booming! There is huge reported growth which is down to three factors within their business:

- People

- Their strong supply chain

- Being adaptable

There are still opportunities for growth- the market has grown by just under 50% in 5 years. The 4 key berries are still growing but more steadily. John sees premium as a growth area.

Geographically, Peru is predicted to overtake Chile in terms of the volume of berries produced this year.

Most interestingly, the producers of British summer fruits, still are competitors but have opted to work together to drive growth.

In terms of the marketing of products, the trend is to continue with direct contact with consumer through campaigns.

How does geopolitics affect this sector? Gray suggested that it will be an impact no matter where anyone is in the UK, but suggests to look at it as an opportunity.

Mark Culley (Orchard Fruit Company).

They have seen success after the restructure and renaming to the Orchard Fruit Company. Their focus on an overall capacity allowed them to take cost out and remain competitive. The result: new customers, which are growing in their market space.

Under the previous name, Orchard World which is a company that has existed for 30 years and in that time frame, they have seen many changes.

The “pile it high, sell it cheap” mantra of Tesco is now a memory and in that bygone time, you used to have lots of customers, but now all seemed to have merged. Growers have grown bigger which has allowed retailers to go directly to them . The result: retail grower partnerships and investments.

Therefore it is not necessary for a ‘middle-man’ to connect retailers and growers – this relationship can be direct, hence lowering costs. There are now opportunities in the export market which are ripe for exploration and exports into Asia currently are growing considerably. Can you get better returns from export? Culley suggested that some of their best return is in the export market.

Longer-term visions for Orchard Fruit Company include continue to do what they are doing, whilst being innovative. And in terms of predictions, cherries will continue to grow significantly.

Tom Watson– (MP and Deputy Labour Leader)

Tom Watson was very apologetic for the current Brexit situation and how parliament is dealing with it. He suggested that crashing out of the EU would be a huge political failure and the House of Commons with its complexities makes it very difficult to siphon out plausible solutions. Watson acknowledged how serious the situation is. He went on to say that consumers are not aware of how delicate the situation is for food and in particular produce. His view is that everyone needs to give a little to have continuity.

He went on to say that he doesn’t think the UK will crash out on 31st of October, but he doesn’t know what the next steps are going to be.

Overall the deputy leader of the Labour Party, much like everyone else doesn’t know what’s going on!

Side note, he’s been on a health drive himself which has seen him lose 8 stone over the past few years! He puts it down to changing his eating habits to more fruit and veg!

VEGPOWER

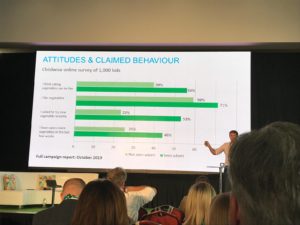

As we all know such a great success story and gave an update on the impact they have had. Eat them to defeat them! campaign was a roaring success. They have compiled a full report which is coming out in October.

They have devised a 10-year mission, that every child, every single day, should be eating one more portion of veg. There is economic value in this plan: £90m to-fresh produce, potentially.

To push this plan through, they have got ITV back on board and added Sky and Channel 4 advertising.

To date, they have raised £850,000 in cash and they obtained £10m worth of free marketing for the campaign. But more needs to be done and that requires further funding.

Take a look here to find out more: https://vegpower.org.uk/

Hugh Pile (Blue Skies)

Blue Skies offer a unique offering in the industry, fresh-cut fruit produced at source in their factories. This leads to fresher product and creating jobs at source.

Pile went on to discuss the methods of recruiting more people into the sector and what moves are needed to get people to join our market. Pile suggested that dipping into brands helps to attract people as it gives a sense of pride and attracts talent in. The key talent market they want to focus on is ‘GenZennials’ who are the generation of people that want to change the world and have a purpose.

Mike Snell- (IPL)

It is an interesting time for retail as there is a concerted effort afoot to cut out the middle-man. But how has the model changed?

Snell looked back to 2004 when IPL was started and to be innovative. It worked well in a monopolistic market, where suppliers are not making enough money and it was very fragmented.

IPL buy all of Asda produce 1/3 pack 1/3 direct 1/3 sourced.IPL has grown outside of fresh successfully. The model expands cautiously and most appropriate to help Asda do what it wants to do.

Supermarkets have now been giving longer-term contracts. Snell is a big fan of this notion, in particular those which last 2-3years as it creates stronger partnerships. The downside of longer-term contacts is that the number of people you can work with is reduced, taking massive business off some suppliers.

Snell was asked, “Would you consider acquiring suppliers?” His answer was, yes, but they would only buy if it added value. Not just to get bigger.

Price and quality remain the number one priority of consumers and provenance has remained further down the list of what consumers really want.

Snell went on to say that we should always look to buy products as close to the selling point.

Sainsbury’s Asda merger: how much of a blow to the Asda side? Snell said that they hadn’t done a great deal of planning for the future but they have improved processes and efficiencies. In effect they trained for a race that they will never run. CMA reasoning behind the block was cost would be higher for consumer. Snell went on to say that he couldn’t figure out why that was a valid reason though and felt it would bring better pricing for customers.

On the topic of Brexit, IPL has prepared as much as they can. He predicts that the ports will cause problems, but those problems are all dependent on what type of Brexit occurs and what shortages happen off the back of whichever Brexit option materialises. What does a no-deal Brexit mean? As IPL is a budget retailer, the best value on offer has to remain. Furthermore, the reduction in plastics needs to be a consideration as it is the biggest single issue in Produce.

Snell says that he views the wider retail market as super competitive. Consumers today have the best options available, ever. The retail winner will be the one who provides the best experience not just price and going forward he felt that shopping in ‘bricks and mortar’ stores will continue but in combination with more online activity.

Guy Singh Watson (Riverford Organics)

This talk was a great insight into his life and how he has grown Riverford Organics.

Employee ownership (which stands at 74%) is a key factor in the lifeblood of the organisation as they have a meaningful say over their future.

A key point he made was that we need to make consumers understand the value of produce, seasonality etc. We should be driving this and not just trying to make money out of it.

Vernon Mascarenhas (Natures Choice)

Mascarenhas used this platform to talk about their industrial warehouses and vertical farming.

Such methods are affordable when products are imported as the product cost comes down.

Vertical farming is attracting interest from buyers and consumers and it is perceived that products grown in this way will be available from the end of 2020.

Chris Hutchinson (Spitalfield Markets)

Big changes are afoot for Spitalfield. Land near Dagenham has been purchased which will be used to become a site for selling meat, fish, fruit and veg. Something the location may be a worry due to logistical issues, but Hutchinson is hugely optimistic for such changes.

Simon Martin and Pierre Koffmanns (Koffmanns/Food Heroes)

Koffmann was established due to a gap in the market. Chefs wanted to have a hold on the conditioning, quality and taste of produce they were using.

Koffmann has a pipeline of new brands coming to the market in the next six months, including, sauces.

In terms of next steps for the business, it is not their intention to look at retail. However, they have had conversations with various retailers as they want a point of difference.

Sally Orange (Sally Orange Charity)

This was a great talk, discussing fruit costumes running marathons and the mental health benefits which can be obtained from eating fresh produce.

Minette Batters (NFU)

Batters suggested that the conflicting messages, consisting of lightweight conversations with no detail, have been offered by the Government about Brexit, which is in its purest form the most extraordinary time of change. If we do leave without a deal the only three product areas without tariff protections are cereals and grains, eggs and horticulture.

The talk then shifted in the direction of labour for farming and it was suggested that the government is not doing enough to meet the need. At present, workers (particularly those from other European nations) are being affected by the devaluation of the currency and also feel less welcome. Such ideas mean that immigration is at the front of the Brexit debate when the focus should be elsewhere because seasonal workers are not an immigration issue. The bulk of people understand this. But now, it has become political and the House of Commons out of touch with this.

However, there is a massive possibility for fresh produce revolution as Brexit has opened the eyes of industry members. They now have a closer connection with what people are eating and Brexit will bring about collective support for buying and sales across the industry.

Trade Deals: the battleground of Brexit. Most countries do not have the same legislation as the UK, that is obvious. Agriculture is a huge part of the US trade deal. However, the EU could put the UK on the waiting list for FTA.

Batters went on to say that aside from Brexit, there is a massive fruit and veg drive to help bolster good health practises. This is coupled with an Environmental Agenda, particularly with regards to climate change where the net change is hoped to become fully sustainable.

Plants and growing more of them is an effective method of CO2 removal. Going forward this relates to people wanting to know what their carbon footprint is and how they can take ownership of it to counteract any perpetuated negative impacts.

Finally, Batters talked about Women in Farming and how there is a drive to encourage more women to get involved in the industry. Batters suggested that more universities are seeing an influx in woman enrolling on courses related to the industry so a follow-through will hopefully occur.

A great event once again from the team at The Fresh Produce Journal, we look forward to next year!

A counter-offer is an interesting conundrum; they usually occur as soon as the resignation process starts. They are tricky to handle and work through and in instances, we have even seen counter-offer’s occur after a candidate has left and started with a new employer.

It is important for an employer to really think carefully when making the counter-offer and for an employee to fully understand and consider when they receive one.

It is important for an employer to really think carefully when making the counter-offer and for an employee to fully understand and consider when they receive one.

One thing is for sure we have definitely seen an increase in counter-offers in the last 18 months across the FMCG sector; we believe that there are a variety of factors for this:

- Unemployment rates in salaried manufacturing and exec roles are at the lowest they have been since the early 1970’s.

- Skills shortages in many positions.

- Economic vulnerability.

- Employers job roles and responsibilities increasing.

- Understanding the real costs associated with reemploying.

- Vulnerability of customer business.

The list could go on.…

From the Employer’s Perspective:

The first question for you as the employer is the need to really understand the motivating factors for resignation, and I’ll let you into a secret: regularly what they tell you won’t be the real reason!

Throwing a counter-offer at an employee when the actual reason is they want to finish early on a Friday isn’t going to be effective. Yes, it might sweeten the deal, but it will come around in the future and the counter-offer you are giving is simply papering over the cracks.

Why are you counter-offering someone who has decided their future is away from your organisation? They clearly haven’t taken the decision lightly! It takes a lot to hand that envelope over and so are you getting a committed person for the future or is it just going to be hassle recruiting a replacement? Better the devil you know than the devil you don’t, maybe?

Think about it carefully. Is this a great opportunity to get some fresh blood into the business, new ways of thinking and experience? Yes, you are going to have to integrate and train a new team member, and possibly pay a fee for the privilege, but you are getting an employee who has made the decision to join you, not join someone else!

And going back to the anecdote about a candidate who left and re-joined a business 3-4 weeks after starting their new role, by accepting a counter-offer: they then left their original employer within three months of re-starting! Why? Because the employee realised actually the counter-offer was the wrong move and it didn’t work for all parties.

The Employee’s viewpoint:

If you are an employee who has been given a counter offer, you need to be clear in your own mind why you started searching for a new role in the first place. If it was down to money, why didn’t you ask for a pay rise? And if you did ask, but the request was rejected, why did your employer change their mind after you resigned? Why are you suddenly worth £5000 more, than you were before you resigned?

There are differing circumstances every time; we are not saying that accepting a counter-offer is wrong, nor is deciding to reject a counter-offer the correct decision either, but it is so important to be judicious when coming to a final decision.

Regularly your recruiter is in the best position to give you advice, and if you think that a recruiter is only in it for themselves and their own self-interest, guess what you are working with the wrong recruiter!

If they state all the facts, lay it out and let you make the decision, and most importantly, inform you impartially, they are doing their job. Inevitably, a recruiter wants to place a candidate in a role which will offer success and longevity: not a short-term placement.

Talk openly with your recruiter: I can cite many examples where our team have picked up a call and talked things through with the candidate and their decision makes sense; sometimes they may disagree because the facts and motivators don’t point to the right decision for them. However, those are the candidates you usually find back on the market again in a matter of months.

Counter-offers, they are all circumstantial:

At face value, a counter-offer may seem like a very flattering proposition. Is the employer saying that they would be unable to cope without you, or are they of the opinion that it will save them a lot of time, money and effort to stick with the status quo? They’ll sweeten you up with a cursory pay rise, perhaps the offer of working from home one day a week and from their side, the problem is solved. But the cracks have merely been papered over, not filled in and fixed.

Showing your desire to move on will mark your card potentially. If you have been tempted by an employer who offers what you perceive to be greener grass, your employer may end up simply sitting in a state of flux, waiting for you to hand over another resignation letter. Trust may be the main casualty and the paper that covered the initial cracks has now been ripped to shreds.

Very often we see those that accept a counter-offer, to go on and leave their employer a short while later but it’s hard to put a factual figure on that. The extra pay rise soon becomes the norm and the employer hasn’t really changed! We have seen it time and time again, that within a short period of accepting a counter-offer, the candidate starts job hunting again: motivations for wanting to leave have not just remained the same, but the reasons have in fact grown. Doing this can give you a negative reputation of being indecisive and if the counter-offer is just a pay rise, then the employer you turned down could feel cheated. Money is important; however your career is also strongly about personal and professional growth and if your paths cross in the future, you could be marked as just someone that is ‘chasing the money’.

That being said, if you are summoned into a meeting room after handing in your notice and your current employer discusses how your position is vital to future growth and that you are going to be part of that future, such a proposition will be very tempting. If they are tangible, then it’s only natural that you should consider what they are offering. By staying you could be a lot more engaged and motivated: it’s the fresh start you wanted, but instead of new surroundings, it’s a new beginning in a place which is familiar.

Ultimately, it is important that you do not commit immediately: go away, take your time and weigh up ALL of the options. The ball is firmly in your court, so don’t immediately decide, but take time to reflect.

At such a juncture, going back to your recruiter is vital to get their sway on it. Furthermore, they should work on tactics and a strategy that works for you to get the best package.

The Final Decision:

The Final Decision:

When crunch times arrives and you have to decide to stay or go, and your decision has been made all the more difficult with a counter-offer, it is likely that you will feel very confused. Have you made the right choice?

Right at the beginning of deciding to hand in your notice, you made the bold step to leave a company and go through the motions of finding a new role because your current employment position did not provide you with fulfilment. Why, therefore, would you really want to go back on that choice if you know deep down, that staying put will be temporary and in the long run futile?

To quote Albert Einstein, “Insanity is doing the same thing over and over again and expecting different results.” I am by no means saying that accepting a counter-offer is an insane move, but if you stick with something that is not delivering for you, ultimately, this will remain a constant.

Moving into relatively unknown territory in a new role can be an intimidating prospect, but so often taking a leap of faith into a new venture will deliver a great many rewards.

The weather was kind to us on Friday 21st June 2019 for our annual golf day held at The Luffenham Heath Golf Club. With the weather being more autumnal over the last few weeks, there was definitely some worry in the run-up that we may have to postpone. Luck was on our side however and the sun did appear.

A total of nine teams took part, made up of some of our valued clients from the Food Manufacturing, Fresh Produce and Horticulture sectors. The golf was mixed at best, with some fantastic scores and some awful ones, but mainly great fun was had by all.

Recruitment Director, Jason Kilbride said:

“The annual golf day is always a day in the calendar which we look forward to. It’s a great opportunity to spend time with clients who have supported us and continue to work with us throughout the years. Luffenham Heath is a beautiful setting and a challenging day.”

We would like to say a huge thank you to all that attended and in doing so, helped to raise some money for our charity. Special thanks to our Office Manager, Natalie Pask who put in so much effort organising the day, which ran very smoothly.

See you again next year!

RESULTS:

1st Prize – Gareth Silverwood – Munoz – 40 points

2nd Prize – Julian Wright – Ripenow – 34 points

3rd Prize – Mike Harpham – Consultant – 34 points

Ladies Prize – Rachel Gedney – TH Clements

Nearest The Pin – Mike Harpham – Consultant

Longest Drive – Louis Meryon – Addo

Team Prize – Gareth Silverwood – Munoz

Richard Dyde – Vitaal

Ian Ball – Total Produce

Mark Player – Munoz

Wooden Spoon – Leigh Jones – Total Produce Food Service

Bandit – Gareth Silverwood (40 points off 28 Handicap!!)

“Jacks” of all trade…. Master of the discount one?

This week saw Tesco launch their new branded retail business “Jacks” to compete with the discounters and regain momentum in the retail war. Wednesday saw the unveiling of the brand by CEO Dave Lewis, which has been a close kept secret by employees and suppliers a like. The first 2 stores in Cambridgeshire and Lincolnshire opened their doors to the public with plans for further launches, 10-15 stores across the UK in the next year.

The rumour mill had been running for months with people wondering whether Tesco’s own label brands Rosedene, Boswell or Willow farms would appear in the new store formats, but after the launch it was clear that Jack’s was going to kept very separate. 1,800 of the 2,600 SKUs in store are branded Jack’s products with the other 800being well known brands.

The store format is fresh, simple and minimal SKU’s as expected. You could be mistaken for walking into an ALDI that had applied Jack’s branded stickers everywhere. Similar to other discounters they have a “WIGIG” (When its Gone its Gone) aisle, stacked high with various items people buy that they don’t actually need.But the one focus and USP they have over the other discount retailers is, as Dave Lewis has put it, “Britishness”. 8 out of 10 products are British and support UK farming and manufacturing and it’s a British retailer.

Jacks is being targeted, and quite rightly, at the “price sensitive customers” with store locations carefully selected in poorer populated areas. They have made a statement to be the “cheapest in town” and their price points are very competitive, what will be the response on price by ALDI and LIDL? Let’s be honest prices are at rock bottom already in the discount stores there isn’t anywhere to go! Low operating costs and deals agreed with suppliers have allowed Jacks to get straight into the discount heavyweight ring. An agreement is also in place that products aren’t sold to Jacks at a lower value than they are Tesco, its saved in supply costs such as packaging.

Wage’s will also be less that Tesco employees in Jack’s stores, different working conditions and lower prices mean staff won’t have access to the Tesco’s benefits packages.

The concept and idea isn’t new, they aren’t revolutionising the wheel but what they are doing is trying to take back slice of the pie. UK retail has changed and Tesco are on board. If you want my honest opinion, I was a little disappointed going around, there wasn’t anything that made me think, that’s clever or that’s new. It’s just an ALDI or LIDL with new branding. I know that’s just what Tesco want but I was hoping for a little innovative thinking. Do I think it will work? Yes, I do, but I don’t see Aldi or Lidl shaking in their boots.

Jason Kilbride

Recruitment Director at Henderson Brown

Henderson Brown Golf Day 2018

Another fantastic event held at Luffenham Heath Golf Club, supporting our charity of the year The Green Backyard. Well attended with figures from across the Food Manufacturing, Fresh Produce and Horticulture sectors, the weather was glorious and although the golf was challenging, all had a thoroughly enjoyable day. Thank you to all of our attendees for their continued support.

Our winner was Steve Rudge; after plenty of practice in the UAE over the last year he held of competition from last years winner Jason Smith. Both definitely marked for a handicap cut next time around! We look forward to seeing you all again next year.

Overall Winner: Steve Rudge

Runner Up: Jason Smith

3rd Place: Andy Coaten

Nearest The Pin: Steve Maxwell

Longest Drive: Peter Ellis

Winning Team: Steve Rudge and Peter Fry