Grocery News

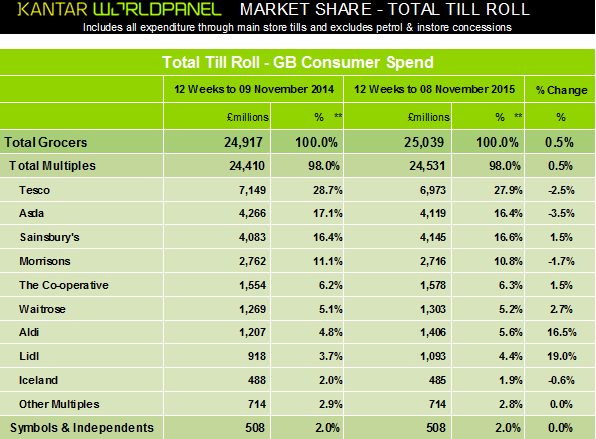

Aldi and Lidl have a combined 10% share of the grocery market for the first time, the latest figures from Kantar Worldpanel (12 weeks ending November the 8th 2015) have revealed.

This has been driven by Lidl as its market share reached a record high of 4.4%, up 0.7% points on last year due to a sales growth of 19%. Aldi grew sales by 16.5%, keeping its market share at 5.6% for the fifth consecutive month.

“If you look back as recently as 2012, Aldi and Lidl only held a 5% share of the market, and it had previously taken them nine years to double their combined share from 2.5%,” said Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel.

“In the last 12 weeks the two retailers have attracted another additional million shoppers compared with last year, while average spend per trip has increased by 4% to £18.85, which is 78p ahead of the total retailer average. The discounters show no sign of stopping and with plans to open hundreds of stores between them they’ll noticeably widen their reach to the British population.”

The grocery market overall saw sales slow by 0.5%, held back by falling prices, which remained down by 1.7% on a like-for-like basis.

However, Sainsbury’s is bucking the trend, seeing its fourth consecutive period of growth with an increase of 1.5% sales to increase its share by 0.2% points. “Sainsbury’s performance means it has once again regained its position as Britain’s second-largest supermarket, pushing ahead of Asda in the latest 12 weeks,” said McKevitt.

Sales fell at the rest of the major retailers with Tesco down -2.5%; Morrisons by -1.7% and Asda by -3.5%.

Waitrose and The Co-operative saw sales rise by 2.7% and 1.5% respectively.

Kantar Worldpanel

Research by mySupermarket.co.uk in October also found that a basket of essentials rose slightly from £85.94 to £86.16 in that month

Morrisons has narrowly come out cheapest in a study of grocery essentials for the month of October.

The monthly study, conducted by mySupermarket.co.uk, the shopping and comparison website, monitors the cost of the same 35 most-commonly bought grocery products.

Overall, it found that a basket of essentials rose slightly from £85.94 in September to £86.16 in October.

The October increase was driven by a sharp rise in the cost of broccoli, up 18%, and mushrooms, up 11%. Only apples fell significantly in price, dropping 11% in price compared to September.

The small rise follows a period of falling grocery prices, with the September basket total of £85.94 having been the lowest in 2015.

mySupermarket analysed the basket cost across the top four supermarkets, Tesco, Asda, Sainsbury’s, and Morrisons, plus Waitrose and Ocado, and found significant differences in price.

Morrisons was the cheapest closely followed by Asda. Ocado was most expensive, with Waitrose coming second bottom.

In comparison to a year ago, though, the same basket in October 2014 would have cost shoppers £89.74, a saving of 4%.

Gilad Simhony, CEO of mySupermarket.co.uk, said: “One side effect of the current supermarket price war – the environment in which supermarkets are fighting for shoppers hard earned pounds – is that the cost of grocery staples are being priced very competitively.

“This is great news for shoppers who are looking to make savings. Another side effect, however, is more confusion regarding which of the supermarkets is cheapest as the price of our favourite grocery products can change on a daily basis. Shoppers need to be aware and take control of their weekly shop as the differences in price can be huge.”

More growth for discount retailers, but Sainsbury’s was the only ‘big four’ retailer to post sales growth over the last month, Kantar data shows

Lidl has achieved a new record share of the UK grocery market.

This is the second successive month Lidl has reached a new share high, and now claims 4.3% of the market, after seeing its growth accelerating to 17.9% in the 3 months to 11 October 2015.

The discount retailer’s growth was particularly strong in Scotland, the scene of its ‘smarter shopping’ card trial.

The latest Kantar Worldpanel data also shows that Aldi saw its revenues rocket by 17.6% compared to last year’s figures.

Sainsbury’s was the only one of the larger supermarkets to see sales growth this period, and a strong performance in its online and c-store channels helped it to increase revenues by 1.1%.

However, Sainsbury’s market share was static at 16.1%.

Sales fell at Tesco by 1.7%, though it is too early to see the impact of its revamped ‘Brand Guarantee’ initiative. At Asda, sales fell by three per cent, bringing its market share down by 0.7 percentage points to 16.6%.

Meanwhile, sales at Morrisons fell by one per cent, taking its grocery market share to 10.8%

Fraser McKevitt, of Kantar Worldpanel, said: “In contrast to the overall market, online grocery sales have increased by 9.8% on last year. Despite this rapid expansion, space for retailers to increase both share and revenue in this area remains, with less than a fifth of households currently shopping online.

“Internet sales offer a chance of long term growth – only 18% of households bought groceries online in the last 12 weeks meaning there’s plenty of space for further expansion. The convenience factor and minimum spend restrictions mean online baskets tend to be larger, averaging £67 in value, compared with £14 for the average bricks and mortar trip.

“Amazon Fresh’s expected full launch early next year could be a major disruptor, bringing down average basket sizes, accommodating on demand shopping, and accelerating the growth of the whole online market.”

There has been further success this period for Waitrose, with sales up by 2.1%; The Co-operative also saw sales grow by one per cent, and Iceland grew for the sixth month in a row, increasing sales by 3.2%, benefitting from a wider range of premium products.

A £600,000 mixture of digital, print, press and underground advertising to target more than five million on-the-go health-conscious foodies

Florette will be producing a super-powered marketing campaign to mark the launch of its Baby Kale range.

A £600,000 mixture of digital, print, press and underground advertising to target more than five million on-the-go health-conscious foodies.

Identified as ‘new wave healthies’, the salad brand believes these consumers have helped to shape Florette’s super-powered marketing strategy.

Florette will be attempting to spark kale conversation across social media, targeting foodies with adverts in publications such as “The Times”, as well as launching a high impact 48-sheet poster campaign coupled with digital escalator advertising across London’s underground.

Elaine Smith, marketing controller at Florette, said: “More consumers than ever are realising the benefits of superfoods and with continued celebrity endorsement, curly kale is a firm favourite. Our latest creation puts a spin on this popular super leaf, which in its traditional form has to be cooked before eating. Baby Kale can be eaten raw in salads and smoothies – as well as being cooked, so it’s never been easier to enjoy all the health benefits of kale.

“For today’s busy consumer, convenience is essential and we wanted our marketing campaign to reflect this by targeting on-the-go foodies, whilst also inspiring them to get creative with their kale. By combining digital buzz with print, press, as well as billboard advertising in high footfall areas, we will be able to do just that and look forward to launching this exciting campaign in the New Year.”

Last year, curly kale was purchased over 14 million times, and the salad specialist believes this opens up a £3.3 million opportunity for the single leaf sector.

Smith added: “We believe that the positive positioning as a versatile ingredient, as a well as a superfood, will help to deliver incremental purchase occasions and incremental cash value to the rest of the single salad leaf category.”

Baby Kale is on sale now in 60g bags at an RRP of £1.29 in Tesco, Sainsbury’s, Ocado and Waitrose, as well as other retailers.

Like-for-like sales also increased by 2.8% at the retailer for the five weeks ending 3 January 2015

Total sales (excluding fuel) were up by 7.0% on the equivalent period at Christmas last year at Waitrose to £728 million.

Mark Price, Waitrose MD, said: “This strong sales performance in a tough trading environment is a tribute to all our partners who work so hard to give the high quality products and outstanding service that customers want all year round and especially at Christmas.

“As a business owned by the people who work here, we can take the long-term view and our Christmas results show the effectiveness of our strategy of investing in good value, in making our shops attractive destinations and in building our online business.”

Online sales also did extremely well compared to the same period last year.Grocery sales through Waitrose.com grew by 26.3%, with wines, flowers and hampers showing a 39% increase.

Premium store and the discounters grow sales and market share at a time when like-for-like prices are down

There was further evidence that the two ends of the grocery market are where the action is with the release of new figures showing strong sales for Waitrose, Aldi and Lidl.

Waitrose was the big winner in the latest Kantar Worldpanel figures, securing a record 5.2% market share on the back of 6.8% growth in the past year. The company has now grown its sales every month since March 2009.

At the other end of the price spectrum, Aldi’s growth might have slowed slightly, but it still recorded a 27% increase versus last year, leaving it with a 4.8% market share.

Fellow German discounter Lidl’s share hit 3.5% after an 18% sales rise.

“We are seeing clear polarisation of the market with both the premium and discount ends of the market gaining share, while the mainstream grocers continue to be squeezed in the middle,” said Kantar’s head of retail and consumer insight, Fraser McKevitt.

Among the big four, Asda continued its form by growing sales ahead of the market – up 1% over the year, compared to like-for-like overall market decline of 0.2% – and boosting its share to 17.3%.

All eyes are on Tesco after its recent struggles. Its sales show a 3.6% decrease, but that at least represents its best figure since June.

Both Sainsbury’s and Morrisons’ sales slipped, by 3.1% and 1.8% respectively.