Brexit

A number of key industry speakers took to the stage on Tuesday 8th October at the Ricoh Arena for the FPJ live 2019 conference. So what were the main takeaways?

The B-word, Brexit of course was a major point for discussion. We were also privy to talks on Fresh Produce Brands; the methods and means of producing more fresh produce; sustainability; robotic innovation; health and fresh produce benefits; food waste and climate change.

Have a read below of our own round-ups of the talks that we attended.

Kantar

Joe Shaw Roberts, Insights Director for Kantar discussed sustainability in the produce sector and the ways in which meat consumption is reducing. 81% of those questioned as to why they moved towards a meat-free/reduced diet, cited health reasons as the main motive.

Joe went on to say that some produce sectors are growing whilst others are not. Products which are going in to plant based meat free meals are rising whilst many other fresh produce items such as broccoli and potatoes are not growing as fast as they usually accompany meat as part of an entire meal.

Trends are showing that sales of whole head produce are growing faster than pre-prepared produce with a rise in cooking from scratch due. This could be attributed to consumers wanting to reduce their packaging waste or simply because it is cheaper. Consumers are becoming more careful about what they buy and want more lbs for their pounds. That being said, further findings suggest that 44% of shoppers are now more concerned about selections on packaging too.

Jack Ward (British Growers Association) and Hayley Campbell Gibbons (ADHB).

In a really interesting talk and one which had everyone fully tuned into. The overarching feeling is that Brexit-systems are not in place and the government is not ready for the 31st of October when it is planned that the UK will leave the EU.

There simply are no answers at the moment as to what will happen. However, there is optimism that a deal will be in place and that no matter what, the flow of goods will continue. Clarity from the government is fundamental in trying to get this.

Any perceived threats and opportunities from outside of EU won’t happen day on day one of departure: the 1st November should be the same as 31st October, if not with some port border challenges.

Going forward, DEFRA budgets will also have a focus on supporting on Automation and crop protection.

The British Growers association remain ambitious despite the uncertainty. They have continued to grow and will continue to support the industry and growers.

Avnish Malde (Wealmoor)

Traditionally, Wealmoor had always been a very private, family-run business. Now though they are more in the public eye and are keen to project their values and ethos to the outside world.

They believe that the global supply chain is important as they have many relationships worldwide. There is much going on and they are trying to further integrate and invest in their farming operations in five countries.

Wealmoor is creating more brands, such as Herbfresh and Saxons Asparagus with the view to create a sense of provenance and owning stories about production. In time they think that they can get more brands out there on the global market, but they want to do so, cleverly, whereby the story is central to each.

They went on to say how sustainability is of paramount importance and they are investing in communities and growers. In the likes of Kenya, they plan to attack the issues of climate change head-on for a more promising future.

John Gray (Angus Soft Fruits)

The berry category is booming! There is huge reported growth which is down to three factors within their business:

- People

- Their strong supply chain

- Being adaptable

There are still opportunities for growth- the market has grown by just under 50% in 5 years. The 4 key berries are still growing but more steadily. John sees premium as a growth area.

Geographically, Peru is predicted to overtake Chile in terms of the volume of berries produced this year.

Most interestingly, the producers of British summer fruits, still are competitors but have opted to work together to drive growth.

In terms of the marketing of products, the trend is to continue with direct contact with consumer through campaigns.

How does geopolitics affect this sector? Gray suggested that it will be an impact no matter where anyone is in the UK, but suggests to look at it as an opportunity.

Mark Culley (Orchard Fruit Company).

They have seen success after the restructure and renaming to the Orchard Fruit Company. Their focus on an overall capacity allowed them to take cost out and remain competitive. The result: new customers, which are growing in their market space.

Under the previous name, Orchard World which is a company that has existed for 30 years and in that time frame, they have seen many changes.

The “pile it high, sell it cheap” mantra of Tesco is now a memory and in that bygone time, you used to have lots of customers, but now all seemed to have merged. Growers have grown bigger which has allowed retailers to go directly to them . The result: retail grower partnerships and investments.

Therefore it is not necessary for a ‘middle-man’ to connect retailers and growers – this relationship can be direct, hence lowering costs. There are now opportunities in the export market which are ripe for exploration and exports into Asia currently are growing considerably. Can you get better returns from export? Culley suggested that some of their best return is in the export market.

Longer-term visions for Orchard Fruit Company include continue to do what they are doing, whilst being innovative. And in terms of predictions, cherries will continue to grow significantly.

Tom Watson– (MP and Deputy Labour Leader)

Tom Watson was very apologetic for the current Brexit situation and how parliament is dealing with it. He suggested that crashing out of the EU would be a huge political failure and the House of Commons with its complexities makes it very difficult to siphon out plausible solutions. Watson acknowledged how serious the situation is. He went on to say that consumers are not aware of how delicate the situation is for food and in particular produce. His view is that everyone needs to give a little to have continuity.

He went on to say that he doesn’t think the UK will crash out on 31st of October, but he doesn’t know what the next steps are going to be.

Overall the deputy leader of the Labour Party, much like everyone else doesn’t know what’s going on!

Side note, he’s been on a health drive himself which has seen him lose 8 stone over the past few years! He puts it down to changing his eating habits to more fruit and veg!

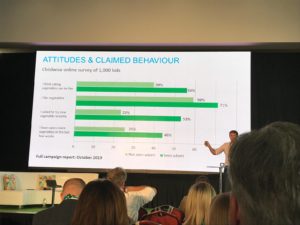

VEGPOWER

As we all know such a great success story and gave an update on the impact they have had. Eat them to defeat them! campaign was a roaring success. They have compiled a full report which is coming out in October.

They have devised a 10-year mission, that every child, every single day, should be eating one more portion of veg. There is economic value in this plan: £90m to-fresh produce, potentially.

To push this plan through, they have got ITV back on board and added Sky and Channel 4 advertising.

To date, they have raised £850,000 in cash and they obtained £10m worth of free marketing for the campaign. But more needs to be done and that requires further funding.

Take a look here to find out more: https://vegpower.org.uk/

Hugh Pile (Blue Skies)

Blue Skies offer a unique offering in the industry, fresh-cut fruit produced at source in their factories. This leads to fresher product and creating jobs at source.

Pile went on to discuss the methods of recruiting more people into the sector and what moves are needed to get people to join our market. Pile suggested that dipping into brands helps to attract people as it gives a sense of pride and attracts talent in. The key talent market they want to focus on is ‘GenZennials’ who are the generation of people that want to change the world and have a purpose.

Mike Snell- (IPL)

It is an interesting time for retail as there is a concerted effort afoot to cut out the middle-man. But how has the model changed?

Snell looked back to 2004 when IPL was started and to be innovative. It worked well in a monopolistic market, where suppliers are not making enough money and it was very fragmented.

IPL buy all of Asda produce 1/3 pack 1/3 direct 1/3 sourced.IPL has grown outside of fresh successfully. The model expands cautiously and most appropriate to help Asda do what it wants to do.

Supermarkets have now been giving longer-term contracts. Snell is a big fan of this notion, in particular those which last 2-3years as it creates stronger partnerships. The downside of longer-term contacts is that the number of people you can work with is reduced, taking massive business off some suppliers.

Snell was asked, “Would you consider acquiring suppliers?” His answer was, yes, but they would only buy if it added value. Not just to get bigger.

Price and quality remain the number one priority of consumers and provenance has remained further down the list of what consumers really want.

Snell went on to say that we should always look to buy products as close to the selling point.

Sainsbury’s Asda merger: how much of a blow to the Asda side? Snell said that they hadn’t done a great deal of planning for the future but they have improved processes and efficiencies. In effect they trained for a race that they will never run. CMA reasoning behind the block was cost would be higher for consumer. Snell went on to say that he couldn’t figure out why that was a valid reason though and felt it would bring better pricing for customers.

On the topic of Brexit, IPL has prepared as much as they can. He predicts that the ports will cause problems, but those problems are all dependent on what type of Brexit occurs and what shortages happen off the back of whichever Brexit option materialises. What does a no-deal Brexit mean? As IPL is a budget retailer, the best value on offer has to remain. Furthermore, the reduction in plastics needs to be a consideration as it is the biggest single issue in Produce.

Snell says that he views the wider retail market as super competitive. Consumers today have the best options available, ever. The retail winner will be the one who provides the best experience not just price and going forward he felt that shopping in ‘bricks and mortar’ stores will continue but in combination with more online activity.

Guy Singh Watson (Riverford Organics)

This talk was a great insight into his life and how he has grown Riverford Organics.

Employee ownership (which stands at 74%) is a key factor in the lifeblood of the organisation as they have a meaningful say over their future.

A key point he made was that we need to make consumers understand the value of produce, seasonality etc. We should be driving this and not just trying to make money out of it.

Vernon Mascarenhas (Natures Choice)

Mascarenhas used this platform to talk about their industrial warehouses and vertical farming.

Such methods are affordable when products are imported as the product cost comes down.

Vertical farming is attracting interest from buyers and consumers and it is perceived that products grown in this way will be available from the end of 2020.

Chris Hutchinson (Spitalfield Markets)

Big changes are afoot for Spitalfield. Land near Dagenham has been purchased which will be used to become a site for selling meat, fish, fruit and veg. Something the location may be a worry due to logistical issues, but Hutchinson is hugely optimistic for such changes.

Simon Martin and Pierre Koffmanns (Koffmanns/Food Heroes)

Koffmann was established due to a gap in the market. Chefs wanted to have a hold on the conditioning, quality and taste of produce they were using.

Koffmann has a pipeline of new brands coming to the market in the next six months, including, sauces.

In terms of next steps for the business, it is not their intention to look at retail. However, they have had conversations with various retailers as they want a point of difference.

Sally Orange (Sally Orange Charity)

This was a great talk, discussing fruit costumes running marathons and the mental health benefits which can be obtained from eating fresh produce.

Minette Batters (NFU)

Batters suggested that the conflicting messages, consisting of lightweight conversations with no detail, have been offered by the Government about Brexit, which is in its purest form the most extraordinary time of change. If we do leave without a deal the only three product areas without tariff protections are cereals and grains, eggs and horticulture.

The talk then shifted in the direction of labour for farming and it was suggested that the government is not doing enough to meet the need. At present, workers (particularly those from other European nations) are being affected by the devaluation of the currency and also feel less welcome. Such ideas mean that immigration is at the front of the Brexit debate when the focus should be elsewhere because seasonal workers are not an immigration issue. The bulk of people understand this. But now, it has become political and the House of Commons out of touch with this.

However, there is a massive possibility for fresh produce revolution as Brexit has opened the eyes of industry members. They now have a closer connection with what people are eating and Brexit will bring about collective support for buying and sales across the industry.

Trade Deals: the battleground of Brexit. Most countries do not have the same legislation as the UK, that is obvious. Agriculture is a huge part of the US trade deal. However, the EU could put the UK on the waiting list for FTA.

Batters went on to say that aside from Brexit, there is a massive fruit and veg drive to help bolster good health practises. This is coupled with an Environmental Agenda, particularly with regards to climate change where the net change is hoped to become fully sustainable.

Plants and growing more of them is an effective method of CO2 removal. Going forward this relates to people wanting to know what their carbon footprint is and how they can take ownership of it to counteract any perpetuated negative impacts.

Finally, Batters talked about Women in Farming and how there is a drive to encourage more women to get involved in the industry. Batters suggested that more universities are seeing an influx in woman enrolling on courses related to the industry so a follow-through will hopefully occur.

A great event once again from the team at The Fresh Produce Journal, we look forward to next year!

Brexit: a conundrum of magnitude. Will it happen? Won’t it happen and if it happens, will it go through with or without a deal? With uncertainty looming most ominously, we can only speculate just what the impacts will be.

It is suggested that the UK is only 60% self-sufficient when it comes to food, according to government figures, and 70% of its food imports come from the EU – but then we have become a nation addicted to avocadoes and year-round iceberg lettuce, will we starve as a nation? Most certainly not but availability and choice will be restricted. The departure with or without an agreement will have upheaval on what we see on our shelves after the day that Brexit does arrive.

Are we going to face situations where food is in short supply? Predictions suggest that within days of the UK’s European Union departure, shortages could occur. But what we do know is that necessity is the mother of all invention and we will still be eating – what are consuming though, might be different and might cost more for a while. However, as a nation it is likely we will not starve.

Many experts however across the British food industry, a great number of whom are producers, farmers and retailers which the British public depend on, are genuinely very nervous. No one doubts that there will be potential disruption to the food supply chain which could result in unharvested produce and empty shelves in the supermarkets. However, the supply chains from Europe have products to sell, and they simply can’t shift it anywhere else. Conversely the British consumer wants to buy them.

So where will this lead us? The truth is no one has a clue!

Towards the end of January, CEO of the UK trade body, Food and Drink Federation, Ian Wright said that a no deal Brexit would be “potentially catastrophic” and the Prime Minister was not giving adequate attention to the concerns held by the food industry. Such apprehensions have been heightened since the deal on the table was thrown out of parliament in January. Speaking with Business Insider earlier in February, Wright said:

“We keep telling them [the government] that it [a no-deal Brexit] is potentially catastrophic but it is difficult to know just how much they’re listening.”

In an effort to mitigate a disastrous fallout, various food manufacturers have started to stockpile ingredients and finished products out of fear of supply shortages. CEO Siobhan Talbot of Irish dairy and sports nutrition company, Glanbia, spoke with The Irish Times and told the newspaper:

“We have stocks in the UK, more than we would normally have. We are very much planning for a no-deal at this stage, we have all the supply chain alternatives, all those pieces that one would expect but that does not mean that that would be easy and that does not mean that that wouldn’t be without its implications.”

Of course, Brexit isn’t just going to impact on food production; anything linked to the industry will be at the mercy of the subsequent halo effect. Most of the food safety laws in the UK stem from legislation passed by the EU. This includes the legal necessity for food businesses to use food safety management systems which are based on the codes of HACCP for food safety management. Questions have arisen as to whether or not such legislation will be retained. It is unlikely to change as the approach is a global one and importantly, The World Health Organisation (WHO) established international food standards which act as a legislative base for countries throughout the world. To throw out the rule book would be pure madness then. It is likely that existing food safety legislation will simply be ‘cut and pasted’ and then restamped with a Union Jack instead of a European flag.

The legislative framework is not nonsense, however, and they provide a solid foundation for food safety to operate. It is believed therefore that if and when Brexit does happen, a review of the legislation will inevitably transpire, but it is unlikely that much in term of amendments would need to follow. If the requirements are unnecessarily cumbersome, then change may happen, and this could be for the better.

Labelling and packaging of goods which are intended for export from the UK into the EU will need to adhere to and comply with EU law. As such making these changes for the sake of it, would not be prudent and could be harmful. The biggest predicted changes are to food safety however; the number of enforcements visits may be decreased to ease the legislative weight.

Future labour availability is probably going to be one of the biggest impacts on British Food and Fresh Produce from leaving the EU. We have as a nation had a ‘cheap labour tap’ which has been flowing since 2004. Immigration, one of the bugbears of many who voted out, has fed the British economy with abundant, motivated and very often well trained and educated labour which has worked in the food factories and packhouses as well as in the fields picking fresh produce. This tap has effectively been turned off and this will have consequences for the industry. Stories of produce rotting in the fields are rare and are probably more down to flushes causing gluts, or over planting than pure labour availability. However the indigenous British population has historically been reluctant to pick fresh produce from the fields, so will this change?

Most certainly not, so how will it get picked? The answer is going to be in the short term enhanced labour rates to attract people to undertake these tasks and in the longer term, automation. But, despite the press releases from the universities working on these projects, realistically these are 3-5 years away. The cost of production and subsequently the prices of fresh fruit and vegetables will increase. Therefore it will be interesting to see whether the retailers will absorb these costs or pass them on.

Is it coincidental that we have seen wage growth creep above inflation for the first time in over a year and we are seeing levels of unemployment fall to the lowest since the mid-1970’s? As the labour tap has turned off, are we seeing the forces of restricted labour supply and continued demand force up wages? Let’s see.

Logistically, getting food into and out of the UK once Brexit has occurred is likely to change. Some have made a guesstimate that if an additional two minutes are required to check trucks and lorries, this could generate a 17-mile tail-back within a single day. The Dutch fruit and vegetable exporters are working on a lorry passport scheme which is designed to reduce these potential problems by creating a fast track for their goods. They want to sell it and the consumers will want to buy it – will market forces inevitably not come in to play?

Logistically, getting food into and out of the UK once Brexit has occurred is likely to change. Some have made a guesstimate that if an additional two minutes are required to check trucks and lorries, this could generate a 17-mile tail-back within a single day. The Dutch fruit and vegetable exporters are working on a lorry passport scheme which is designed to reduce these potential problems by creating a fast track for their goods. They want to sell it and the consumers will want to buy it – will market forces inevitably not come in to play?

Some businesses who we speak to have taken on a more stoic standpoint and are getting on with it, rather than waiting to see what happens. Some of the shrewder operators have been getting into the swing of things with new product development and focussing on creating new or alternative items which can be sourced locally and do not come directly from the continent.

From an environmental perspective, the reduction in food miles could be a welcome result from the exit process. Several of the more innovative businesses have investigated specifically how food mileage can be shrunk or negated and developed new initiatives that specifically tackle this issue. One good example is growing food aquaponically (a fusion of aquaculture and hydroponics). If this approach is applied to growing salad items, it is considered that food miles can be cut down to almost zero. This could remove problems such as those faced in Spain in early 2017 due to unseasonably cold weather that had the knock-on effect of a salad shortage in the UK. Shrinking the number of miles food must travel or negating the carbon footprint associated with growing and transporting produce, at least, will have a positive effect on the environment.

New technology is not always the answer though, but adaptations to ones already in existence or indeed considering the opportunities of looking at readily available alternatives. With regards to market supply, it would be necessary to review supply bases to ensure that the best value is on offer. Understanding where the potential kinks in the chain are (regardless of a crisis, if that is indeed what Brexit is), is necessary to prevent a weakness causing a snowball effect. The result of carrying out such reviews, therefore, should reveal what unnecessary efforts can be removed with the result being, improved efficacy of the supply chain.

On the whole, the outlook of what the impacts of Brexit will be on the food industry are in the short term more negative than positive. But – we simply don’t know what will happen – if anything will change at all! The uncertainty is definitely affecting business confidence as we have clients who have delayed investment projects until April and have held back on some senior appointments until there is more clarity.

But until B-Day arrives, and that specified date is still up in the air, no one can say with absolute confidence just want the future holds. Until then, is it business as usual? To keep the nation fed, it will have to be.